The ideal tax services resume will demonstrate your passion for the profession and what motivates you to keep getting better at it, along with a healthy dose of achievements and evidence of your skills.

Most people are well aware of the basics of a resume; however, there are specific steps that those in the financial sector can take to ensure their resume stands out in the crowd. Our comprehensive guide, filled with the best writing tips, resume samples, detailed examples, and customizable templates will show you all you need to know.

Keep reading to discover our tips:

- Get inspired by handy tax services resume examples

- Choose the best format for your tax services resume

- Craft an attention-grabbing resume summary or objective

- Market your best hard and soft skills in your tax services resume

- Customize your tax services work experience section to a specific role

- Enrich your tax services resume with strong action verbs

- Make an impact with your tax services resume education section

- Tailor your tax services resume extra sections to the job listing

- Avoid common mistakes in your tax services resume

- Pair your tax services resume with a matching cover letter

- Learn about the average salary and job outlook for tax services professionals

- Find the best resources for job-seeking tax services professionals

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

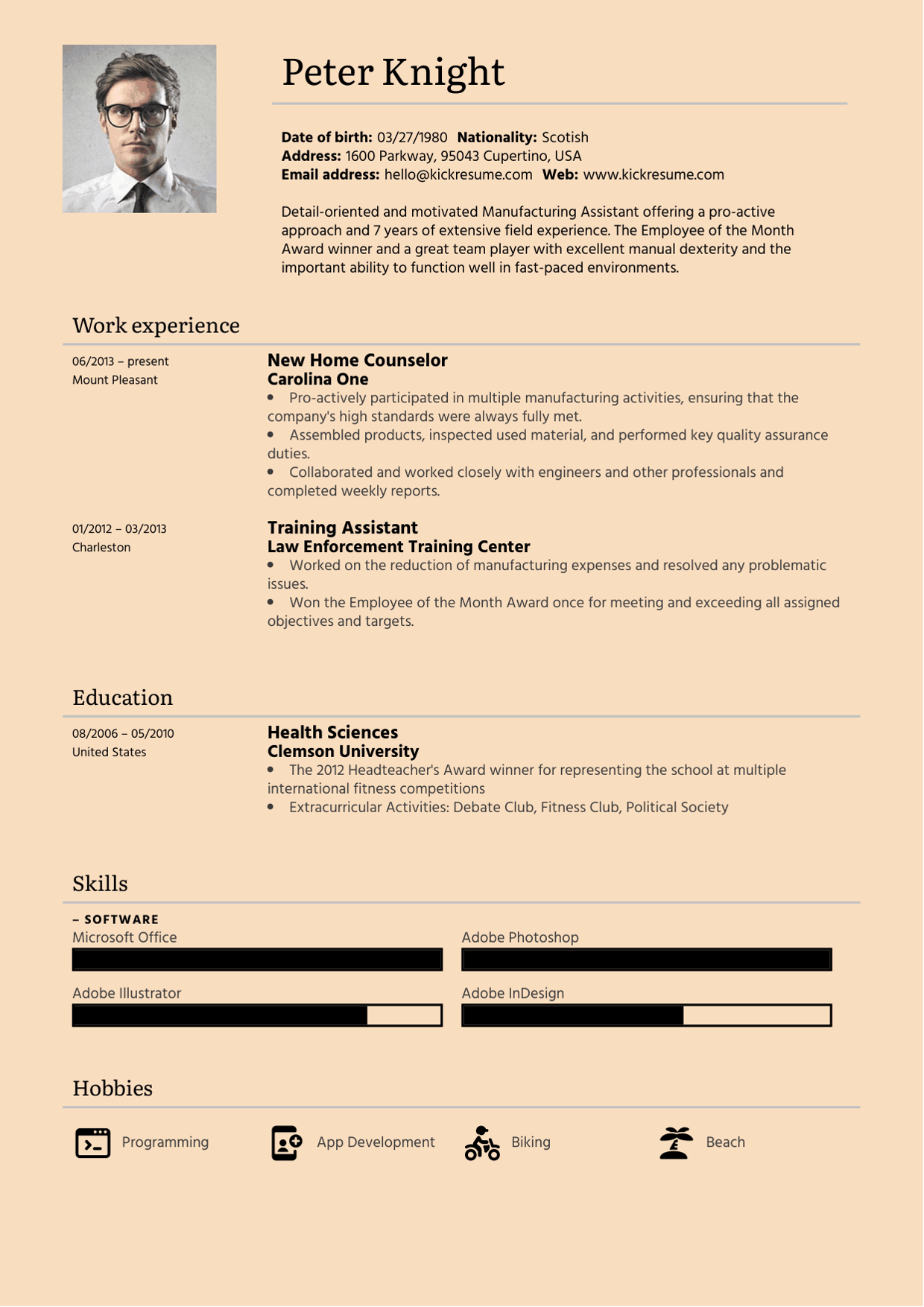

Tax consultant resume template

Why does this resume example work?

- Effective resume summary: The resume starts strong with a well-crafted summary that immediately grabs attention. It clearly outlines the candidate's role as a Tax Consultant and highlights key strengths. The profile also emphasizes their ability to thrive in high-pressure environments, which is a valuable trait in the tax industry.

- Flashed out skills section: The skills section is comprehensive and balanced, listing both technical skills (like proficiency in Microsoft Office, TurboTax, and other tax software) and interpersonal skills (such as communication, problem-solving, and teamwork). This mix is great because it shows that the candidate is not only capable of handling the technical aspects of tax consulting but also has the soft skills needed to work effectively with clients and colleagues.

What could be improved?

- Inclusion of quantifiable data: While the work experience section lists the candidate's duties and achievements, it lacks quantifiable data that could make their impact more concrete. Quantifying achievements, like "prepared and reviewed 150+ tax returns annually, ensuring 98% accuracy rate," would provide a clearer picture of the candidate's impact.

IRS tax examiner resume example

Why does this resume example work?

- Use of action verbs: The resume makes good use of action verbs in the work experience section. Words like "Verified," "Managed," or "Resolves" effectively convey the candidate's proactive role in their previous positions. These verbs help to create a dynamic and engaging picture of the candidate's abilities, highlighting their willingness to take initiative and perform their tasks with confidence.

- Inclusion of relevant keywords: The resume includes industry-relevant keywords that are likely to pass through ATS. Keywords like "Tax Examiner," "audits," "computer processing," and "analytical skills" are directly related to the tax and finance field.

What could be improved?

- More focused work experience section: The resume lists several different job experiences, but not all are equally relevant to the Tax Examiner role. The jobs at Bon Appetit and Macy's, while they showcase valuable customer service skills, could be summarized more briefly to focus more on the Tax Examiner experience. Alternatively, the candidate could highlight any transferable skills from those roles that are particularly relevant to a tax position.

- Spicing up the resume summary with specific achievements: The profile section of the resume is a good start, but it could be stronger by including specific achievements or unique selling points that differentiate the candidate. For example, instead of just stating that they have "a proven track record of success in meeting all assigned objectives," the candidate could mention a specific accomplishment, such as "successfully resolved 95% of taxpayer inquiries on first contact."

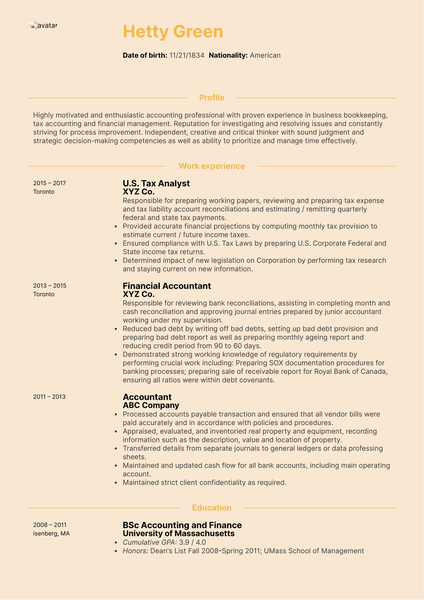

Income tax preparer resume example

Why does this resume example work?

- Strong educational background: The education section is a standout feature of this resume. The candidate not only lists their degree and institution but also provides specific achievements like "Achieved First Class Honours, ranking in the top 3% of the Programme." This detail adds weight to their academic credentials. Additionally, their involvement in extracurricular activities like the Economics Society and TEDx Club suggests that they are proactive and engaged with their field beyond the classroom.

- Relevant skills and certifications: The resume also does a good job of listing relevant skills and certifications that are directly applicable to a career in tax services. Skills such as "QuickBooks," "Xero," "Sage," and "MS Office" demonstrate the candidate’s familiarity with essential software used in the field. This technical competence is further supported by their certification.

What could be improved?

- More professionally relevant hobbies: While listing hobbies such as "Sport," "Reading books," and "Traveling" adds a personal touch, it doesn’t directly enhance the candidate’s professional profile. The hobbies section could be tailored to include activities that align more closely with professional interests or skills relevant to the job. For example, mentioning "Reading financial news and tax-related literature" or "Participating in local finance and business workshops" would be more effective in this case.

1. How to choose the best format for your tax services resume

Let’s face it — picking the right format for your tax services resume has more weight than you might think. The way you organize your resume can be the difference between catching a hiring manager’s eye or getting lost in a pile of applications.

A good format puts your strengths front and center, tells a clear story of your career, and makes a strong impression. So, let's take a look on the three main types of resume formats and see which one suits your needs the best:

- Reverse-chronological format: This format is by far the most widely used format. It lists your work experience in reverse chronological order, starting with your most recent job and moving backward. This format is ideal if you have a solid, uninterrupted work history in the tax or finance field and want to highlight your career progression.

- Functional (skill-based) format: The functional resume, on the other hand, shifts the focus more on your skills and qualifications rather than on a chronological listing of your work history. It's the perfect choice for anyone who doesn't have a continuous employment history in a specific field, such as recent graduates, job-hoppers, those with gaps in their work history, or career changers. This format allows you to tailor your resume to highlight the skills most relevant to the job you’re applying for.

- Hybrid (combination) format: The combination resume, as the name suggests, blends elements of both the chronological and functional formats. It typically starts with a summary of your skills and qualifications, followed by a detailed work history section. As a result, this format offers a balanced view of both your skills and experience. For these reasons, this format works best for mid-level professionals who want to highlight both their skills and their work history.

PRO TIP: If you're submitting your job application via the ATS, always opt for the chronological format. The unusual structure of a functional resume may confuse the software and ruin your chances of having your resume reviewed by the hiring manager.

All in all, in the field of tax services, where practical experience and specific skills are paramount, aligning your resume format with your career history and goals is essential. Whether you choose to organize your resume according to the chronological, functional, or hybrid format, make sure you've carefully considered all three options.

If you want to skip the part when you need to set up proper margins, pick the most professional font, or decide on how to make your headlines pop, you can save yourself some time and use one of our professionally designed resume templates.

2. How to craft an attention-grabbing resume summary or objective

When it comes to writing a standout tax services resume, one thing you absolutely don’t want to skip is crafting a strong resume summary or objective. These two elements sit right at the top of your resume and serve as your elevator pitch.

Think of them as your opening statement — they're there to quickly grab the hiring manager's attention within the first few seconds of reviewing your resume and make them want to keep reading.

Writing a resume summary

A resume summary is a brief statement (3-5 sentences in length) that highlights your professional experience, key skills, and most notable accomplishments. It’s perfect if you’ve been in the tax services game for a while and want to showcase your career achievements and expertise right off the bat. The goal of a resume summary is to give a quick overview of what you bring to the table and how your experience aligns with the job you’re applying for.

What should your resume summary include?

- Professional identity: Make it clear who you are — Tax Professional, Certified Public Accountant, Tax Consultant, etc.

- Experience: Mention your years of experience in roles that are relevant to the position.

- Key skills: Focus on the skills that are most relevant to the job you're applying for.

- Achievements: If you can, throw in a couple of quantifiable achievements.

Consider these two examples and see which one works better:

Bad tax services resume summary example

Experienced in taxes and finance. Worked with many clients and have a lot of skills. Looking for a job that will allow me to use my knowledge. Team player and hard worker.

Why does this feel so flat? First off, it’s vague — saying you’re “experienced in taxes and finance” doesn’t tell us much. How many years of experience do you have? What kind of tax work have you done? And what about all those “skills” you mentioned? You need to be specific about those too. Next, this summary also lacks any quantifiable achievements or keywords that could catch a hiring manager’s eye or get past an ATS. Plus, phrases like “team player” and “hard worker” are super generic and don’t say anything unique about you.

Good tax services resume summary example

Detail-oriented Tax Professional with over 5 years of experience in tax preparation, compliance, and audit support. Proven track record of managing tax filings for over 150 clients annually, reducing filing errors by 30%, and achieving 100% on-time submissions. Skilled in utilizing tax software such as TurboTax and Lacerte to optimize tax strategies and improve client outcomes.

What makes this sound so much better? This summary is packed with specifics, showing exactly what makes this candidate a top-notch tax professional. We know they have over 5 years of experience and a proven ability to handle a large client load. Plus, they’ve quantified their success with quantifiable data that demonstrate their effectiveness and reliability. The mention of specific tax software tools like TurboTax and Lacerte shows they’re also tech-savvy and up-to-date with industry standards.

Writing a resume objective

A resume objective, on the other hand, is more about your career goals and how they align with the position you’re applying for. This is a great choice if you’re a recent graduate, new to the field, or switching careers. A good resume objective tells the employer not only what you want but also how you plan to contribute to their team.

What should your resume objective include?

- Career goal: Clearly state the role you’re aiming for and how it fits within your career plans.

- Relevant skills or experience: Highlight any relevant skills or experiences you bring to the table, even if they're from another industry.

- Focus on how you’ll add value: Explain how you plan to use your skills to benefit the company or meet its needs.

Bad tax services resume objective example

I want to work in a tax department where I can learn more about taxes and use my skills. I’m looking for a job that offers good benefits and a friendly environment. Seeking to advance my career in a company that values hard work.

What makes this resume objective ineffective? This resume objective is vague, generic, and doesn’t offer any specific information about the candidate’s skills or experience. It lacks a clear connection to the job they're applying for and doesn’t demonstrate any knowledge of the company's needs or how the candidate can add value to the team. It focuses more on what the candidate wants from the job rather than what they can bring to the role.

Good tax services resume objective example

Recent graduate with a Bachelor’s degree in Accounting and hands-on experience from a tax internship at TaxForYour Inc. Skilled in tax preparation, financial reporting, and client consultations, with a solid foundation in federal and state tax regulations through coursework in Advanced Taxation. Eager to bring my analytical skills to a junior tax associate role, where I can contribute to a collaborative team and continue to develop professionally.

Why is this resume objective so much better? The candidate immediately mentions that they have a relevant degree in Accounting and real-world experience from a tax internship, which shows they’re not just book smart but have applied their knowledge in a professional setting. The mention of specific skills and courses like tax preparation and financial reporting is great, as it aligns with what hiring managers in the tax industry are looking for.

Whether you choose to start your CV with a summary or an objective, don't forget to enrich it with relevant keywords! Many companies use Applicant Tracking Systems (ATS) to scan resumes for specific keywords related to the job. If your resume doesn’t have these keywords, it might not even make it to a human being!

3. How to market your best hard and soft skills in your tax services resume

Work experience section aside, it's your skills that hiring managers are the most eager to see. Why? Because your skills are what set you apart from the crowd. While your experience and education show what you’ve done and where you’ve been, your skills demonstrate what you can actually do.

However, the skills you choose to include on your resume need to be relevant to the job position you're trying to secure. If you aren't sure which skills to include, check your job posting for clues.

Based on their nature, skills can be further divided into hard and soft skills:

- Hard skills: These are the technical abilities you’ve picked up through education, training, or hands-on experience. These skills are specific to your job as a tax services professional, like knowing how to prepare tax returns, understanding the intricacies of tax law, or being able to use specialized tax software.

- Soft skills: Soft skills are more about how you work and interact with others — think about attributes like communication, problem-solving, and adaptability. In the tax services field, soft skills are crucial because you’re often working directly with clients, interpreting complex information, and collaborating with team members.

The best hard skills for your tax services resume

- Tax Preparation and Planning

- Knowledge of Tax Laws and Regulations

- Financial Analysis and Reporting

- Use of Tax Software (like TurboTax, QuickBooks, Lacerte, or UltraTax)

- Auditing

- Accounting Principles.

- Regulatory Compliance

- Data Analysis

The best soft skills for your tax services resume

- Communication Skills

- Analytical Thinking

- Problem-Solving

- Client Management

- Adaptability

- Time Management

- Collaboration

- Attention to Detail

Once again, be mindful when choosing which skills to include on your resume as they are often the keywords that hiring managers and ATS are looking for. Additionally, tailoring your skills to match the job description is key because it shows that you’re not just submitting a generic resume but actually paying attention to what the employer needs.

4. How to customize your tax services work experience section to a specific role

So, you’ve got your resume set up, and now you’re staring at the work experience section, wondering how to make it shine. Here’s the secret: customization is key.

When it comes to landing a job in the tax services field, a one-size-fits-all resume just isn’t going to cut it. Instead, you want to tailor your work experience to the specific role you’re applying for.

So, the first thing you need to do is identify the employer's needs, challenges, and goals. For this reason, we recommend doing a bit of research before writing your resume:

- Review the job description

- Research current industry trends

- Check out the employer’s website

- Visit their LinkedIn profile

- Follow their social media posts

Then, take account of your past work experience and pick those that are the most relevant and the most recent.

Bad example of an experience entry on a tax services resume

First Tax Firm

Tax Associate

January 2021 – Present

- Handled various tax-related tasks

- Helped with different projects

- Did some data entry and filing

- Talked to clients when needed

- Used office software to perform tasks

- Assisted the team with general duties

What's wrong with this example? This entry is about as vague as it gets, and that’s the problem. It’s so generic that it could apply to almost any job, not just a tax services role. “Handled various tax-related tasks” and “helped with different projects” don’t tell the reader anything specific about what the candidate did or accomplished. Plus, phrases like “did some data entry” and “talked to clients when needed” are just filler — they don’t show any real skills or impact.

When you're detailing your achievements and duties on your resume, less is often more. Be concise and selective — highlight the accomplishments and responsibilities that truly showcase your skills and impact. Instead of listing every single task you’ve ever done, focus on the standout moments that will grab a hiring manager’s attention.

And don’t forget to employ numbers whenever you can. Quantifiable data provide concrete evidence of your achievements and make your impact easy to see. For example, “spearheaded a project that increased client satisfaction by 25%” is far more compelling than simply saying you “worked on client projects.”

Good example of an experience entry on a tax services resume

First Tax Firm

Tax Associate

January 2021 – Present

- Spearheaded the preparation and filing of tax returns for over 200 individual and business clients, resulting in a 20% increase in client retention.

- Enhanced tax compliance processes by implementing new procedures, which decreased errors by 15% and improved overall accuracy.

- Mentored a team of three junior tax preparers, providing guidance and training that led to a 25% reduction in processing time.

- Conceptualized and developed a new client intake system using tax software, streamlining data entry and reducing administrative workload by 30%.

- Accomplished timely submission of all tax filings with a 100% compliance rate, consistently meeting all deadlines.

Why is this better? This entry is a winner because it’s specific, impactful, and brimming with strong action verbs. It highlights significant achievements with concrete numbers to back them up. For example, “spearheaded the preparation and filing of tax returns for over 200 clients” immediately shows the scale of responsibility and the positive impact on client retention.

PRO TIP: If you're switching careers, focus on any skills that you've picked up in your previous jobs which could be useful in your new professional pursuit. These skills are also known as transferable skills and they usually consist of soft skills like teamwork, communication, or leadership.

Tips for fresh graduates

If you've just graduated and lack professional experience, you can capitalize on your internships, academic work, or freelancing gigs. If you decide to go with the chronological or the combination format, you can treat these as your work experience entries.

Good work experience entry example for fresh graduates

ABC Accounting Firm

Tax Intern

June 2023 – August 2023

- Assisted in preparing and filing over 100 individual and small business tax returns, contributing to a 15% increase in departmental efficiency.

- Conducted detailed data analysis and financial reporting as part of a team project, leading to the successful identification of discrepancies and corrections valued at $20,000.

- Collaborated with senior tax associates to streamline tax compliance processes, which improved accuracy in filings and reduced processing time by 10%.

- Developed a comprehensive tax checklist based on current regulations, which was adopted by the team to enhance workflow and ensure compliance.

- Presented findings from tax research projects to senior staff, demonstrating the ability to interpret complex tax laws and apply them effectively.

In summary, when detailing your work experience, focus on showcasing the value you added in your previous positions. Incorporate specific numbers to illustrate your accomplishments, and make sure to customize each entry to emphasize the skills and experiences that are most pertinent to the job you’re targeting.

5. How to enrich your tax services resume with strong action verbs

You might have noticed in previous examples our use of action verbs. Take this as a gentle reminder to include them in your resume, too, because these little powerhouses can truly elevate your application.

Action verbs are the words that add a punch to your resume. Instead of saying you “were responsible for” a task, an action verb lets you say you “led,” “managed,” or “developed” something. In other words, they make you seem more proactive and driven.

Powerful action words for a tax services resume

- Analyzed

- Prepared

- Advised

- Streamlined

- Audited

- Implemented

- Collaborated

- Maximized

- Managed

- Resolved

If you're wondering how you can use these in your resume, feel free to draw inspiration from our examples:

Example of action verbs to use in a tax services resume

- Analyzed complex financial statements and client data to identify discrepancies, resulting in the recovery of over $15,000 in unpaid taxes.

- Prepared and filed over 200 individual and corporate tax returns annually, ensuring compliance with federal and state regulations and reducing filing errors by 20%.

- Streamlined the tax filing process by implementing a new software system, which reduced processing time by 30% and increased accuracy.

- Advised clients on tax strategies and planning, resulting in a 25% reduction in their annual tax liabilities.

- Managed a team of 5 junior tax associates, mentoring them through complex audits and increasing overall team productivity by 40%.

Action verbs help you convey your achievements with clarity and energy. So, next time you’re crafting your resume, don’t just settle for passive descriptions. Choose strong, dynamic action verbs to bring your accomplishments to life and make your resume shine.

6. How to make an impact with your tax services resume education section

Let’s talk about a section on your resume that doesn’t always get the love it deserves: the education section. You might think that your work experience does all the heavy lifting, but when it comes to tax services, your education is actually pretty important.

If you’ve been in the tax services field for a while, you might think your education isn’t as critical to highlight anymore. Not true! Even as an experienced professional, your education section still plays a crucial role. This is especially the case if you have advanced degrees, certifications, or specialized training that’s relevant to your field.

Here’s how an experienced professional might present their education section:

Education section for your tax services resume example

Education

Master of Science in Taxation

University of Illinois, Urbana-Champaign

Graduated: 2015

Certifications

Certified Public Accountant (CPA), 2016

Enrolled Agent (EA), 2018

Relevant Coursework

Advanced Tax Law, Corporate Taxation, Financial Reporting

Tips for fresh graduates

If you're still a student or a recent graduate with little to no professional experience, don't be afraid to flash out your education in greater detail. Here’re some of the information you can expand on:

- Relevant coursework

- School projects

- Internships

- Academic awards

- Receiving a scholarship for excellent results

- Extracurricular activities related to the field of tax services

Here’s an example of a well-structured education section for students/fresh graduates

Bachelor of Science in Accounting

University of Texas, Austin

Graduated: May 2023

- GPA: 3.8/4.0

- Honors: Dean’s List (2021, 2022, 2023)

- Relevant Coursework: Tax Accounting, Federal Income Tax, Auditing, Financial Accounting, Business Law

- Capstone Project: “Tax Strategies for Small Businesses” — Conducted a comprehensive analysis of tax planning strategies and presented findings to local business owners.

Remember, the further you progress in your professional career, the less room you'll have to dedicate to your education section. For students, detailed education can be crucial for proving their skills to handle the workload. Conversely, candidates with 7+ years of experience don't have to explain their academic background too much.

7. How to tailor your tax services resume extra sections to the job listing

Alright, we’ve covered the essentials but what about those extra sections on your resume? At first glance, these sections might seem like add-ons, but when done right, they can be your secret weapon to stand out from the crowd.

So, how do you make sure these extra sections are doing the most for you? Easy — you tailor them to the job listing. This means carefully reading the job description and picking out the keywords, skills, and experiences the employer is looking for. Then, think about which of your extra experiences best align with these requirements.

Examples of extra section which would elevate your resume include:

- Certifications

- Awards (gained in competitions, granted by critics or reputable magazines)

- Volunteering activities

- Projects you've taken part in

Example of extra sections in a tax services resume

Certifications

- Certified Public Accountant (CPA), 2020

- Enrolled Agent (EA), 2021

- Advanced QuickBooks Certification, 2019

Professional Affiliations

- Member, National Association of Tax Professionals (NATP)

- Member, American Institute of CPAs (AICPA)

Awards and Honors

- “Outstanding Tax Associate,” ABC Tax Firm, 2022

- “Employee of the Month,” March 2021, recognized for client service excellence during tax season

Volunteer Work

Community Tax Assistance Program

Tax Preparer

February 2021 – Present

- Prepared and filed over 50 tax returns for low-income families.

The extra sections on your resume aren’t just fillers — they’re opportunities to shine and make your resume more personalized and compelling. By tailoring these sections to the job listing, you show potential employers that you’re the perfect fit for the role.

8. How to avoid common mistakes in your tax services resume

We’ve all been there: you're getting ready to apply for that dream job in tax services, you’re feeling good about your resume, and then — bam! — you realize there’s a glaring mistake or something crucial missing. It’s easy to overlook the small stuff, but when it comes to your resume, every detail matters.

Before you submit your job application, make sure you read your resume carefully to avoid any of the following:

- Overlooking spelling and grammar errors: Spelling and grammar errors might seem minor, but they can be a big red flag to employers. A resume riddled with typos and mistakes suggests a lack of attention to detail. In your profession, you’re dealing with numbers, regulations, and compliance — there’s no room for errors.

- Underestimate the power of formatting: You might have the perfect content, but if your resume looks like a hot mess, it's not going to do you any favors. Employers want a resume that is easy to read, neatly organized, and professionally presented. Keep your formatting clean and consistent. Use bullet points to break up text, stick to one or two easy-to-read fonts, and make sure there’s enough white space.

- Failing to customize your resume for each job application: It’s tempting to send the same resume to every job you apply for, but that’s a rookie mistake. Employers want to see that you’ve put in the effort to tailor your resume to the specific job and company. A generic resume is easy to spot and might make the employer think you’re not really interested.

- Neglecting soft skills: Sure, tax services are all about numbers and regulations, but soft skills like communication, teamwork, and problem-solving are just as important. If you’re not highlighting these on your resume, you’re missing out on a chance to show employers that you’re well-rounded and can handle the client-facing and team aspects of the job.

- Lack of quantifiable achievements: Simply listing your duties doesn’t show the value you brought to your previous roles. Quantifiable achievements show that you can deliver real results. For example, instead of saying “prepared tax returns,” say “prepared over 200 individual and corporate tax returns annually, with a 98% accuracy rate.”

- Providing outdated contact information: You’d be surprised how many people forget to update their contact information. If an employer tries to reach you and gets a disconnected number or an email that bounces back, that’s a missed opportunity right there!

- Favoring duties over achievements: Listing job duties is fine, but it doesn’t show what makes you stand out from other candidates. Employers want to see how you went above and beyond, not just what your day-to-day responsibilities were.

- Ignoring keywords: Make sure to use keywords from the job listing throughout your resume. This doesn’t mean you should just stuff your resume with buzzwords — make sure the keywords are naturally integrated and relevant to your experience.

- Including irrelevant information: You might think it’s cool that you were the captain of your college chess team, but unless it directly relates to the job you’re applying for, it’s not helping your case. Keep your resume focused and relevant to the position.

Crafting a top-notch tax services resume takes a bit of effort, but avoiding these common mistakes will set you on the right path. Remember, your resume is more than just a list of your past jobs — it’s your personal marketing tool.

9. How to pair your tax services resume with a matching cover letter

A cover letter is a document that, together with a resume, makes up the core of any good job application. Unlike a resume, which is more focused on presenting the facts and figures, a cover letter allows you to introduce yourself, explain your interest in the position, and elaborate on your qualifications in a more personal style.

Although the content of both of these documents will inevitably overlap, avoid having your cover letter simply repeating the information already written in your resume. Instead, have your cover letter provide more narrative context for your skills, experience, and achievements.

A truly well-executed cover letter should provide employers with answers to the following questions:

- Who are you?

- Why are you interested in this position?

- Why do you want to work for us specifically?

- How can you contribute to our success?

Another way in which a cover letter differs from a resume is in the way it presents its content. Resumes are structured in distinct sections, each focusing on different aspects of your professional background. In contrast, cover letters are organized into interconnected paragraphs that flow logically from one to the next.

To ensure that both your resume and cover letter adhere to the same visual standards, keep follow these basic principles:

- Use a matching header: Both your resume and cover letter should have the same header, including your name, contact information, and date. This immediately establishes a visual link between the two documents.

- Choose the same font size and style: Use the same font family for both your resume and cover letter. For example, common professional fonts include Arial, Times New Roman, Calibri, and Helvetica.

- Maintain the same margin size: Similarly, be careful to use the same margin sizes for both documents. Standard margins are 1 inch on all sides, but you can adjust them slightly if necessary.

- Keep your color scheme consistent: The colors you use should be limited to only three shades. Anything more extravagant could detract from the overall professionalism of your job application.

- Use templates to achieve a unified look: For example, each of Kickresume’s professionally designed resume templates is paired with a matching cover letter template. The only problem you'll face is the dilemma of choosing which design you like the most!

In conclusion, ensuring that your resume and cover letter have a consistent design is essential for presenting a cohesive and professional personal brand. This consistency not only makes your application visually appealing but also underlines your attention to detail and commitment to excellence.

10. Learn about the average salary and job outlook for tax services professionals

Tax services are a field that offers a solid mix of stability and growth. Taxes aren’t going anywhere. As long as people are earning money and businesses are making profits, there will always be a need for tax experts. That means job security is pretty high, which is always a plus!

According to the most recent data gathered by the U.S. Bureau of Labor Statistics (BLS), updated in May 2023, the average annual salary for tax services occupations has reached $58,530. Of course, your real salary may vary depending on your skills, accomplishments, qualifications, and years of experience.

Other factors that can influence your salary include:

- Geographic location

- Freelancer vs employee

- Private vs public sector

The employment outlook for tax services professionals also remains positive. The BLS projects that employment for these occupations will grow by 1% from 2022 to 2032.

Accordingly, the BLS expects to see about 4,100 new job openings for tax services professionals each year over the decade.

There’s also a growing demand for tax professionals who have expertise in specific areas, like international tax, state and local tax, and tax planning for high-net-worth individuals. As businesses continue to expand globally and tax laws become more complex, the need for specialized tax professionals is expected to rise.

Whether you’re just starting out or looking to make a career switch, tax services can offer a fulfilling, financially rewarding career path. So, if you’ve got a head for numbers and a heart for helping people, this might just be the perfect fit for you!

11. Where to find the best resources for job-seeking tax services professionals

Whether you're just starting out or looking to take the next big step in your career, having the right resources at your fingertips can make all the difference. The tax services field is full of opportunities, but knowing where to look and how to present yourself is key.

- Professional job boards: Many job platforms such as Indeed, LinkedIn, and Glassdoor display posts for tax services roles. For industry-specific job sites, check out TaxTalent or AccountingJobsToday.

- Networking platforms: LinkedIn takes the crown here. Not only can you find job postings, but you can also connect with other tax professionals, join related groups, and stay updated on industry news.

- Professional organizations: Join groups like The National Association of Tax Professionals (NATP) or the Taxation section of the American Bar Association. They can provide you with professional development resources, networking opportunities, and job listings.

- Career services: If you're still studying or have recently graduated, your university's career service office can be a great asset. They often have job placement help, resume assistance, and other useful resources.

- Recruitment agencies: Several firms like Robert Half and Randstad specialize in roles for finance and tax professionals.

- Courses & certificates: To propel your career, you should consider expanding your qualifications by enrolling in certification programs like those offered by AICPA & CIMA, National Association of Enrolled Agents (NAEA), The Income Tax School, or the Accreditation Council for Accountancy and Taxation (ACAT).

Job seeking can feel like a rollercoaster sometimes, with its ups and downs, twists and turns. But remember, every challenge you face in the process is just another step closer to where you want to be. Sure, it can be a little overwhelming at times, but that’s all part of the journey. Stay persistent!

Tax Services Resume FAQ

How can I effectively use keywords in my tax services resume?

Start by carefully reviewing the job description and identifying recurring terms and phrases related to skills, qualifications, and responsibilities. Then, incorporate these keywords naturally throughout your resume, particularly in the skills section, work experience, and summary or objective. For example, if the job listing frequently mentions “tax compliance” and “financial reporting,” ensure these phrases appear in your resume where relevant.

How should I handle gaps in my work history on a tax services resume?

Addressing gaps in your work history requires a thoughtful approach. If the gap is brief, you might not need to highlight it explicitly. However, for more noticeable gaps, consider using a functional or combination resume format that focuses on your skills and accomplishments rather than chronological work history. Be honest about the gap if asked.

What should I include in my resume if I’ve worked with diverse types of tax clients (e.g., individuals, small businesses, corporations)?

If you’ve worked with a diverse range of tax clients, highlight this experience in your resume to show your versatility and broad expertise. You can separate your experience into categories if needed, such as “Individual Tax Clients” and “Corporate Tax Clients.” Describe the types of services you provided to each group and any specific accomplishments or challenges you faced.

How can I demonstrate my ability to stay updated with changing tax laws and regulations?

The best way to do this is by mentioning any continuing education or professional development activities you’ve engaged in. For example, include memberships in professional organizations, subscriptions to industry publications, or attendance at relevant seminars and workshops.

How should I address experience with tax audits on my resume?

Detail the scope of the audits you’ve worked on, your role in the process, and any outcomes or improvements resulting from your involvement. For example, you could write, “Conducted and managed tax audits for corporate clients, leading to a 30% reduction in audit discrepancies by implementing improved documentation practices.” This shows potential employers that you can handle high-pressure situations and have a thorough understanding of tax regulations.

![How to Write a Professional Resume Summary? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Profile.svg)

![How to Put Your Education on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Collage-Universities.svg)

![How to Describe Your Work Experience on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/Experience.svg)